Driving Value through Strategic Sourcing: Best Practices and Insights

Strategic procurement is frequently perceived as a linear process, often synonymous with the Request for Proposal (RFP) phase. However, this view overlooks the multifaceted nature of strategic procurement. To truly unlock its potential and drive tangible benefits for an organization, strategic sourcing must be viewed as an ongoing cycle of assessment and decisive action.

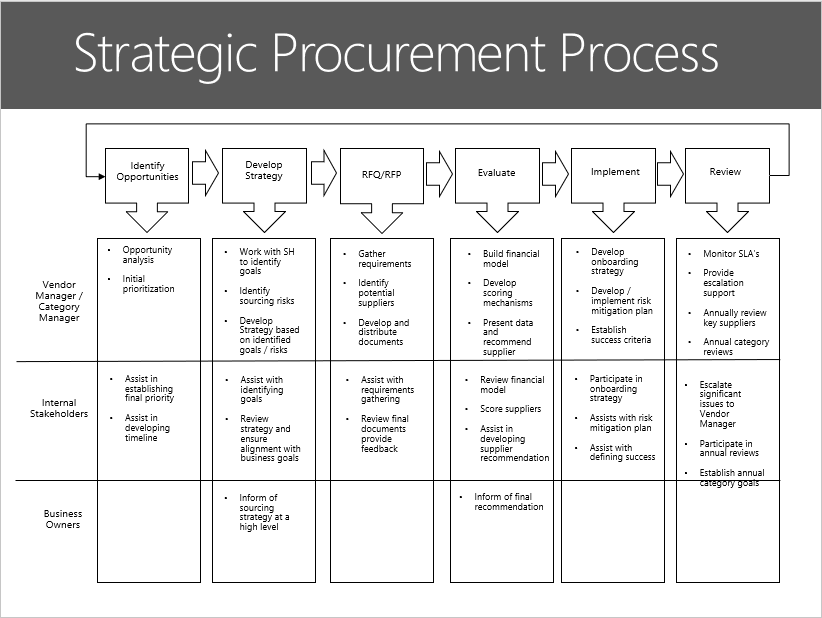

Establishing a standardized strategic procurement process within an organization and effectively communicating it to stakeholders are fundamental pillars of success. Through my experience, I've crafted a comprehensive process delineating each phase's roles and responsibilities. Ensuring clarity among team members regarding expectations is paramount. To facilitate this, I utilize straightforward swim lane charts for smaller initiatives and comprehensive RACI (Responsible, Accountable, Consulted, and Informed) charts for larger projects.

Now that the process is in place and all stakeholders are informed, the next step is to begin identifying strategic procurement opportunities. These opportunities can arise through various channels:

- Vendor performance reports: Feedback from stakeholders or analysis of Key Performance Indicator (KPI) reports can reveal significant opportunities, especially when addressing service or performance issues.

- Spend analytics: Data forms the backbone of strategic procurement decisions. Regular compilation and review of data, categorized by specific areas, are essential. Different categories may require distinct spend management strategies; for instance, while commodity procurement may prioritize price competitiveness with numerous suppliers, critical service acquisition might focus on risk mitigation and consolidating spending among a select few suppliers.

- Contract evaluations: Expiring contracts present an opportunity to reassess products or services. Questions such as whether previous sourcing goals were achieved, supplier performance, and changes in the market landscape should guide the decision-making process.

Once opportunities are identified, prioritization becomes crucial. Given the potentially lengthy timeline and involvement of various stakeholders, it's essential to focus on initiatives that promise substantial improvements in quality, transparency, or cost savings.

With our roster of sourcing initiatives established, the next step is crafting a tailored sourcing strategy for each. This entails gathering information and data from diverse sources:

- Market analysis: Examining the current market landscape is crucial. How many suppliers operate in this sector? Have external factors like material cost fluctuations or labor expense escalations affected the industry since the last procurement cycle.

- Stakeholder consultation: Engaging with key stakeholders is invaluable. Understanding their experiences with current suppliers, whether KPIs are being met, and anticipating any shifts in business objectives for the upcoming year are essential. Additionally, assessing the risks associated with sourcing a particular service or product, such as potential cost increases or the operational impact of onboarding a new supplier, is vital.

Once sufficient information is gathered, a comprehensive sourcing strategy can be devised, considering both the overall risk factors and the potential upside for each initiative.

Now, it's time to craft our Request for Proposal (RFP), a document of paramount importance. The manner in which this document is developed and structured can significantly influence the timeline of the initiative. Here are some key considerations:

- Requirements Gathering: Have all relevant stakeholders been consulted to ensure comprehensive understanding and documentation of dependencies? This includes clarifying what information is essential for accounting or other impacted parties.

- Document Structure: Provide clear templates for pricing and services, ensuring suppliers understand how to respond and adhere to the format. Standardizing the document for each initiative will streamline the evaluation process, saving both time and effort for the team.

- Clear Communication: It's imperative that all team members, including suppliers, are fully informed about the process. This includes clarity on the release date and deadline of the RFP, preferred response format, selection criteria, and whether response presentations will be required.

Encouraging active participation from all team members in developing the RFP requirements, criteria, and selecting participating suppliers fosters a sense of ownership and increases buy-in for the process.

The responses have been received, and now it's time to conduct evaluation and scoring. At the outset of this phase, it's crucial to reiterate the initiative's goals to the team. Ensuring that each member evaluates responses through the same lens is imperative.

- Developing Scoring: Creating a scorecard that aligns with the initiative's goals, such as price, service levels, and additional offerings, is essential. Additionally, weighting the score criteria appropriately emphasizes critical aspects; for instance, service levels may carry more weight than price due to the mission-critical nature of the product or service.

- Seeking Clarity Promptly: Establishing a dedicated time for the team to meet with suppliers and address questions is vital. Attempting to manage inquiries solely via email is inefficient and increases the risk of transcription errors.

- Facilitating Decision-Making: Reaching a final decision can pose challenges, particularly when stakeholders have established relationships with suppliers or harbor risk aversion. Presenting unbiased scoring and data from the RFP can assist in guiding the group toward a decision. It's important to highlight both the benefits to the organization and the potential risks associated with a change, fostering a sense of confidence that all aspects of the decision have been thoroughly reviewed.

The decision has been reached, and now we transition into the implementation phase, where the gravity of the process becomes palpable; this is where all the risks reside. The active involvement of every stakeholder is paramount for success.

- Develop and Onboarding Strategy: Crafting a comprehensive onboarding strategy involves addressing various aspects. What information do suppliers need? What systems must they be integrated into? Are there specific paperwork requirements for accounting or legal purposes? A meticulously planned strategy, covering all dependencies, ensures a seamless transition devoid of significant delays.

- Risk Mitigation Strategy: This stage necessitates collaboration with key stakeholders to devise a robust risk mitigation plan. It's also an opportune moment to expand the team, if necessary, to encompass all relevant departments such as accounting, legal, and facilities. While providing guidance as strategic sourcing leaders, it's crucial to facilitate discussions and encourage team members to identify risks and propose mitigation strategies. This fosters increased buy-in and individual accountability for ensuring a successful onboarding process.

- Communication is Key: Effective communication is vital at this juncture. Internal stakeholders must be promptly informed about the decision and the onboarding plan. Suppliers also require clear communication, including identification of all team members involved. Are there new additions to the supplier team now that the sales phase is concluded? Who serves as the designated point of contact for issues? Over-communication is advisable to ensure clarity and alignment among all parties involved.

As the implementation phase draws to a successful close, it's time to shift focus to evaluating the initiative's success.

- Establishing Key Performance Indicators (KPIs): Choose 3-5 KPIs to monitor and report regularly. These KPIs should directly align with business objectives and provide meaningful insights. For instance, if cost control is crucial, track invoices with a percentage variance. If timely delivery is paramount, aim for 95% on-time delivery. Avoid monitoring an excessive number of KPIs, as it can dilute focus and render data less meaningful to the business.

- Availability and Support: Stay engaged with the team and offer escalation support. Especially during the initial stages of a new supplier relationship, addressing issues promptly is crucial. Regular check-ins demonstrate continued commitment and prevent the perception of moving on to the next project too quickly.

- Establishing Business Rhythms: Define expectations regarding the frequency of supplier reviews, KPI reporting intervals, and recipients. Establishing a predictable rhythm of business ensures accountability and facilitates ongoing performance monitoring.

While it may seem like the conclusion of the process, in reality, it marks just the beginning. Embracing a continuous improvement mindset and regularly evaluating initiative success are essential for delivering sustainable results to the organization. Even after decisions are made and contracts are signed, maintaining an open mindset to questioning and improvement is paramount.